This page is also available in:

![]() Deutsch

Deutsch

At ZenInvest, I aim to provide the best roboadvisor reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Zen Invest is for informational purposes only. Please read the full disclaimer.

Overall rating of my Evergreen review

5/5

⭐⭐⭐⭐⭐

‘Top Choice’

As the world of online investing continues to evolve, a new player has emerged as the industry leader: Evergreen.

With it’s modern portfolio management algorithms, this German roboadvisor sets the standard for investment strategies today. The platform is designed for seamless usability, making it easy for anyone to start managing their wealth with confidence.

But what sets Evergreen apart from the competition in terms of its investment options?

In this review, we’ll take an in-depth look at Evergreen, examining everything from the account opening process to the diverse range of investment options on offer.

We’ll also provide our personal insights and opinions on the platform, so you can decide for yourself if Evergreen is the right choice for you.

To start, visit the Evergreen website and follow along with our guide as we walk you through the account opening process.

And be sure to read the FAQs at the end of the review, where we address some of the most common questions about Evergreen.

🎁 Reader Bonus: If you are ready to try Evergreen, don’t forget to use this link when you register to take advantage of their latest promotions.

Evergreen Review: Pros and Cons

In short – Evergreen is a great option for those new to the world of investing.

The platform’s intuitive and user-friendly onboarding process makes it easy to get started, and with the ability to begin investing with no minimum deposit, it’s accessible to investors at all levels.

Evergreen also have a very strong focus on environmental factors with investing, and this is reflected with the brand and importantly on the investing options for us as customers. They are not ‘greenwashing’.

While Evergreen may not currently offer support in multiple languages, its simple and easy-to-use interface, coupled with top-notch customer service, makes it a great choice for beginners.

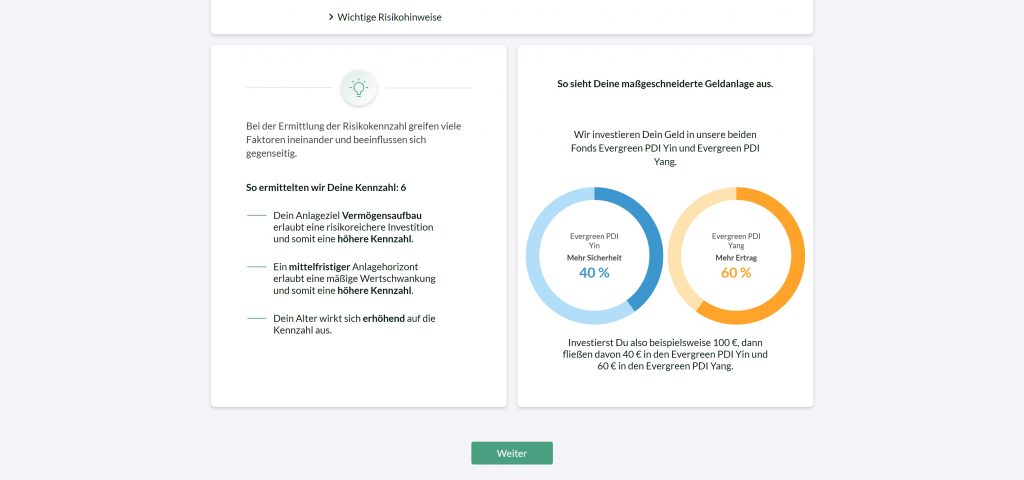

Evergreen offer ten different investment strategies based on their two retail funds, the Evergreen PDI Yin and the Evergreen PDI Yang.

The Yin fund is for those who want to play it safe with an equity quota ranging from 0 to 35 percent, while the Yang fund is for the more adventurous types with an equity quota ranging from 0 to 100 percent.

What’s cool about Evergreen is that they invest in a variety of assets such as global equities, government bonds, corporate bonds and liquidity, and even occasionally in currencies.

But my highlight?

You can start investing with as little as one euro – and the annual costs are super cheap.

So, if you’re just starting out and looking for a reliable roboadvisor to guide you on your investment journey in a green and cost effective way, Evergreen is a great option to consider.

| Pros | Cons |

|

|

How to open an account with Evergreen

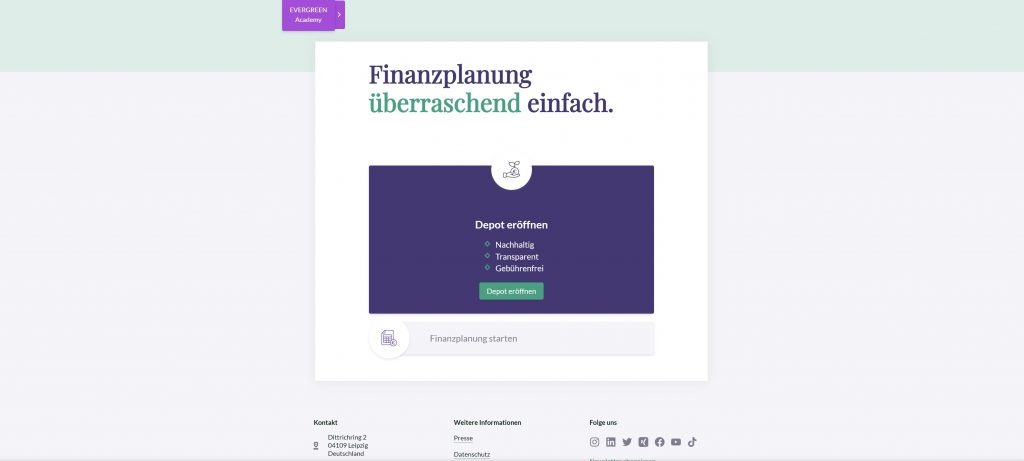

Head over to the homepage at Evergreen to get started.

> Click here to open the homepage

Click ‘Jetzt starten’ to get start:

Next, you can select ‘Depot eröffnen’ or ‘Finanzplanung starten’, I’ve picked ‘Depot eröffnen’ for this example:

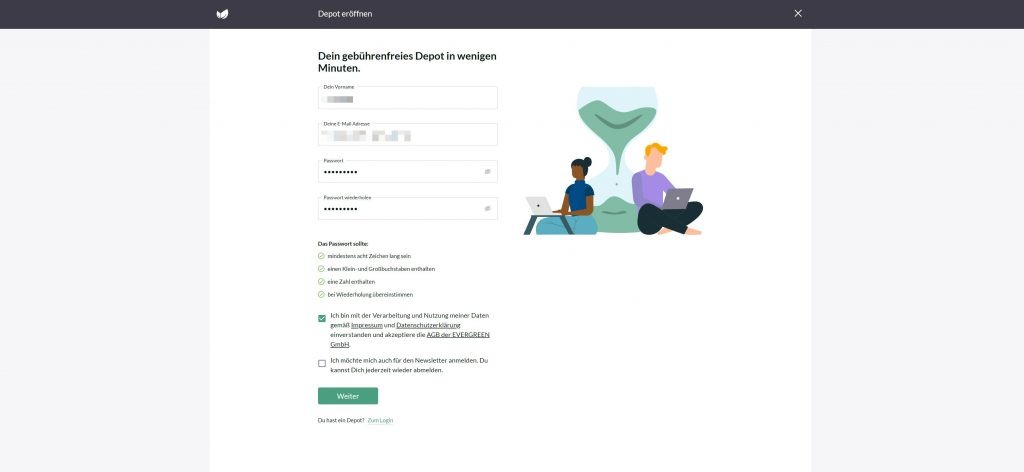

The first step is to enter your name and email address, and a password for your account:

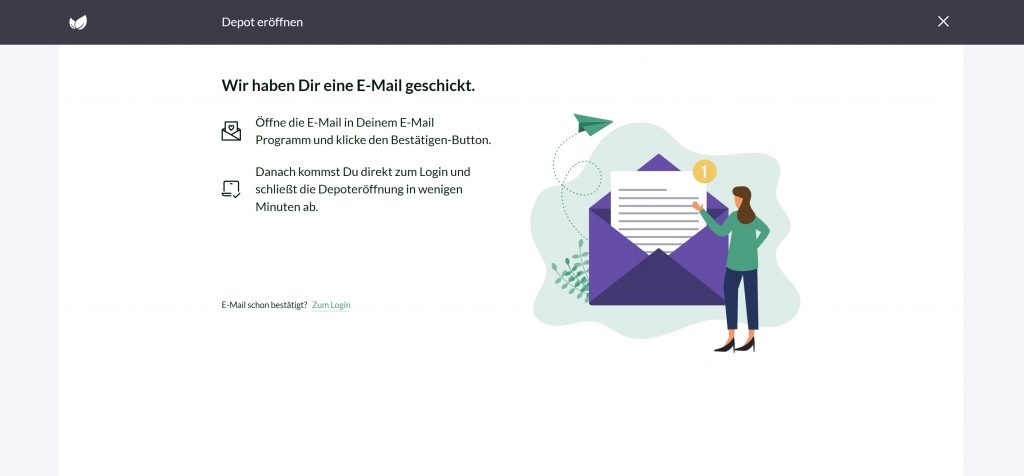

Ok, now you need to switch to your inbox and verify your email:

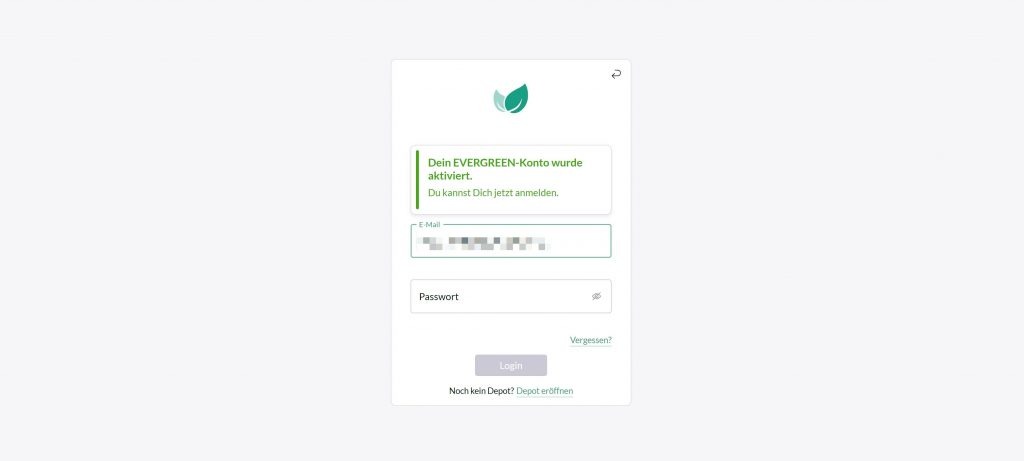

Once done, you can enter your email and password to login:

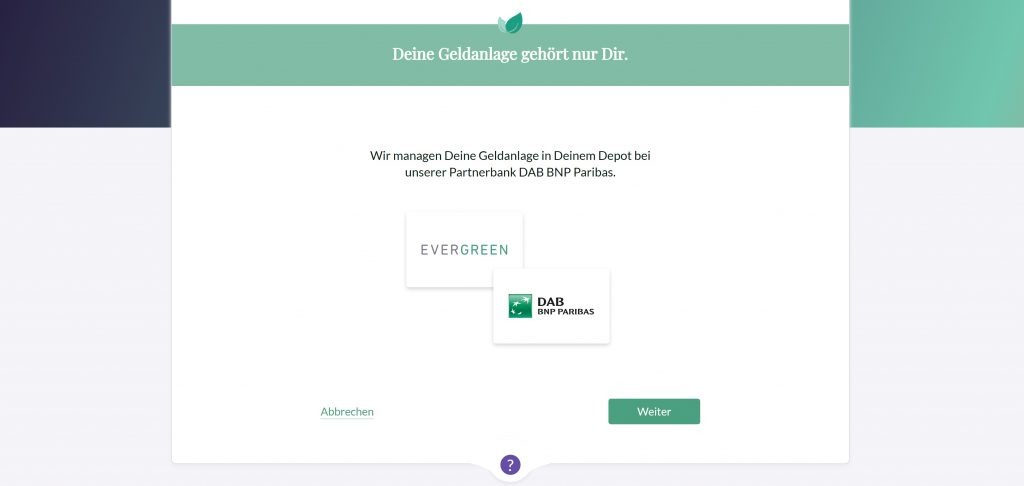

Not much to see here – just the statement to build your confidence – You own the money and it’s held securely with their partner DAB BNP Paribas.

Click ‘Weiter’ to continue:

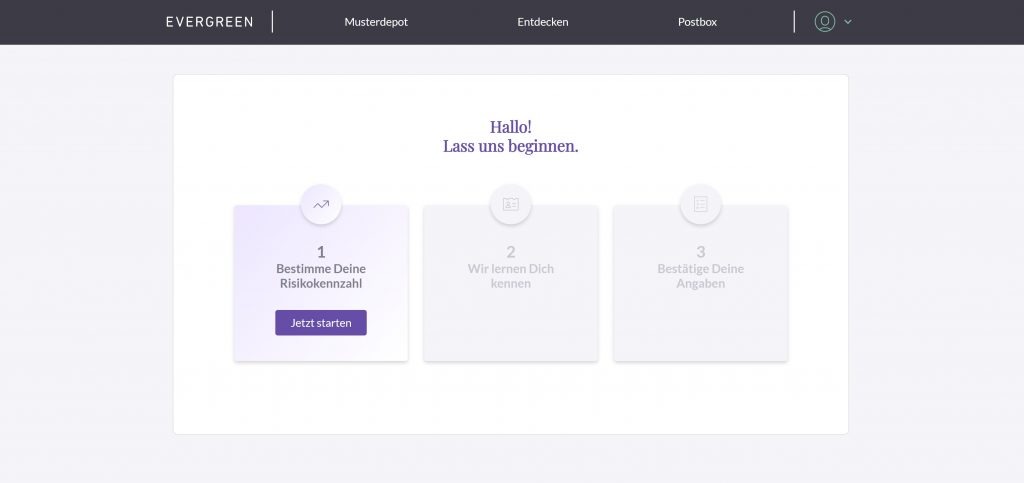

Next a nice welcome screen, and we can get started – click ‘Jetzt starten’ below:

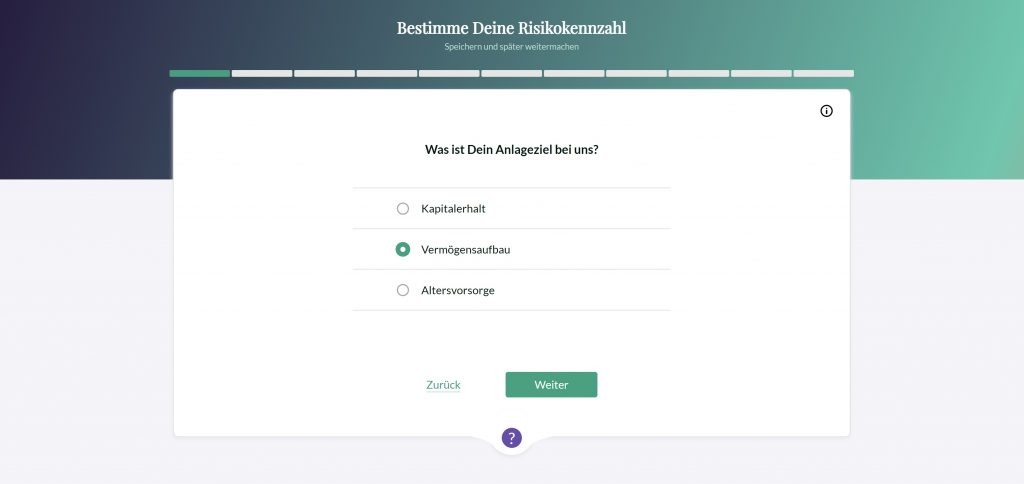

Now we start the questions to work out our investing portfolio. Mark what is your objective with investing with Evergreen and lets move on:

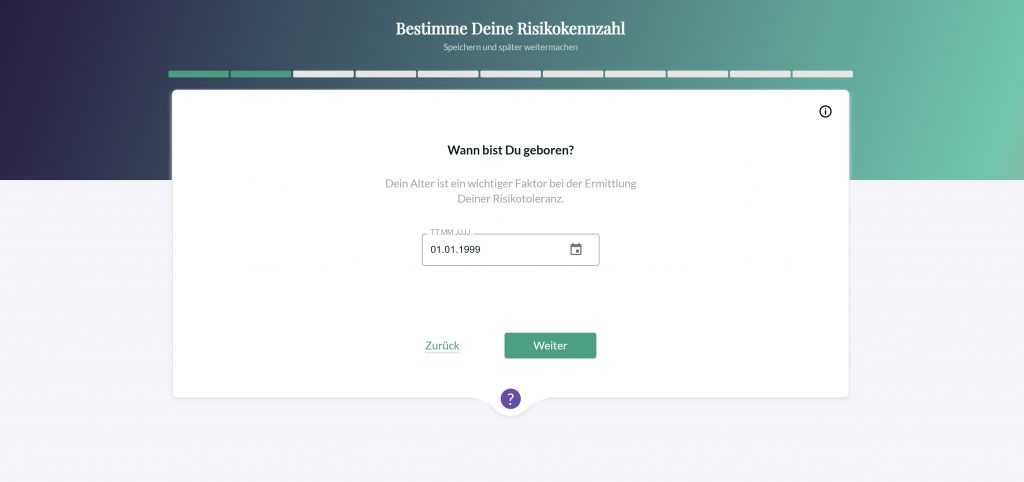

Next, your date of birth:

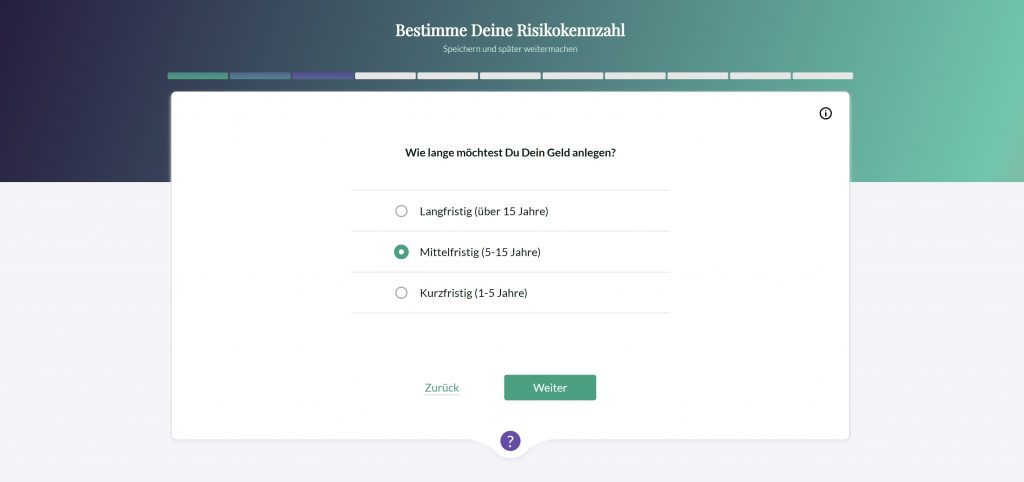

And how long are you looking to invest with Evergreen for?

Make your selection:

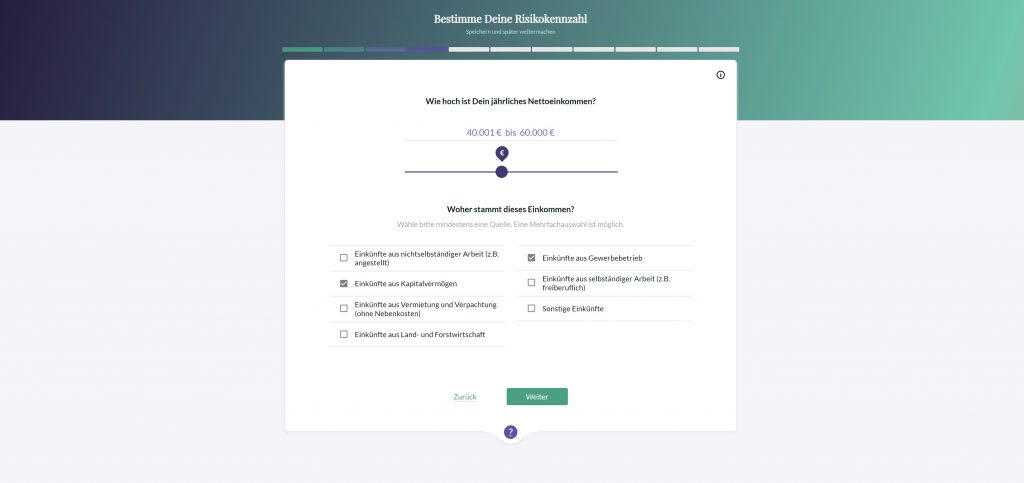

Now give an estimate of how much do you earn per year, and where does the income come from using the checkboxes.

Once selected, click ‘Weiter’:

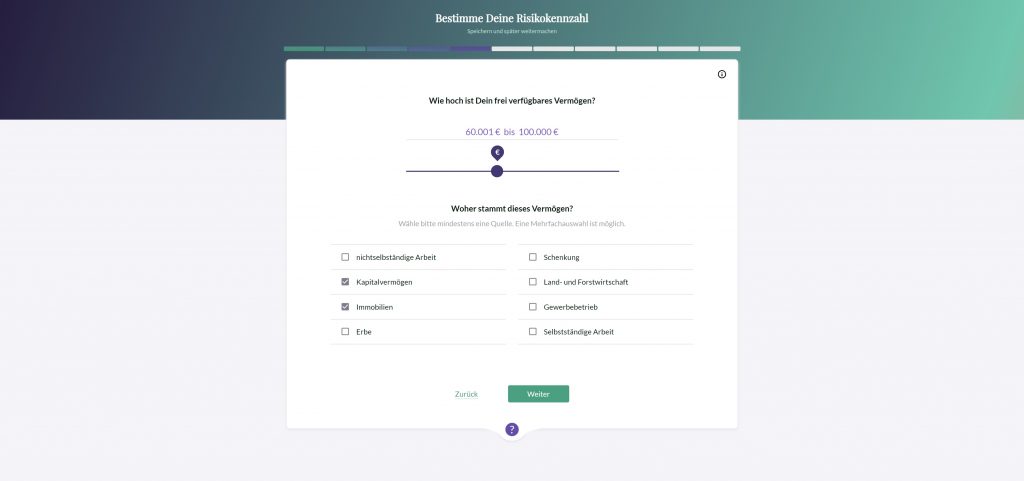

Now you can give an estimate of your savings, and what assets your savings comprise of:

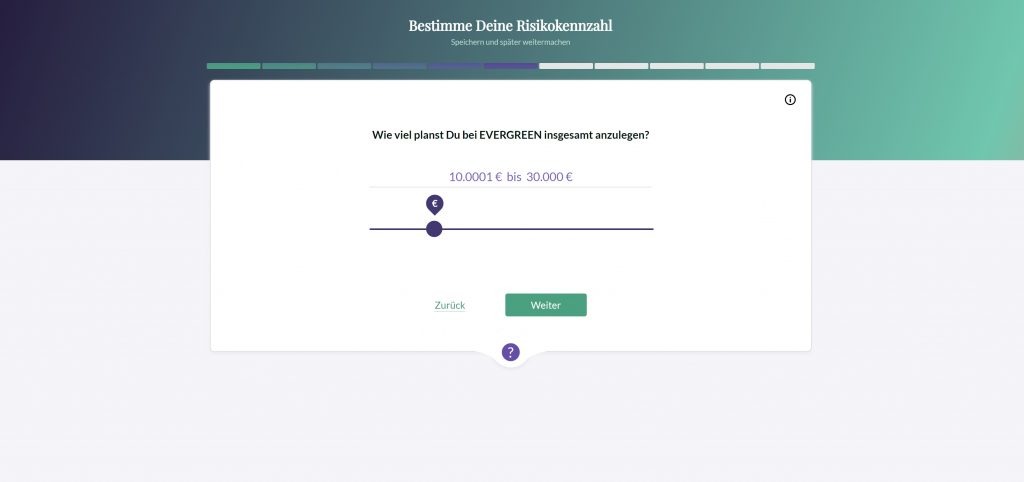

How much are you looking to invest with Evergreen? Use the slider to give an indication:

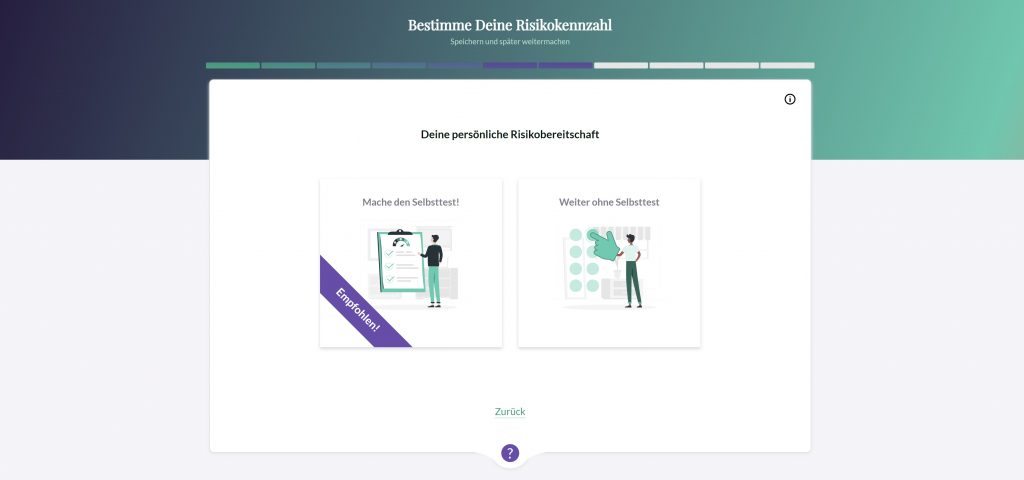

Now you have the option to take a personal risk assessment, you can you choose.

I’ll go through it and you can decide for yourself:

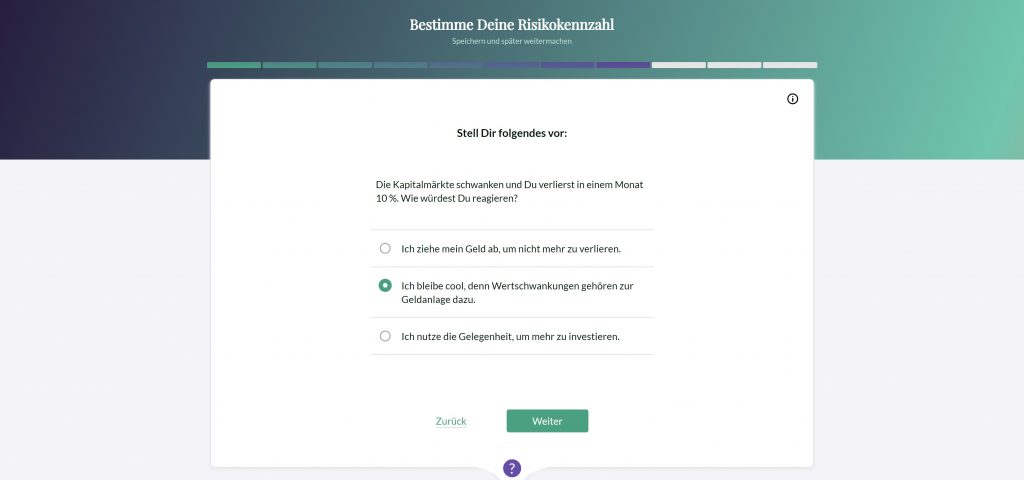

How would you feel if the market tanked? Cool or stressed? Make your selection:

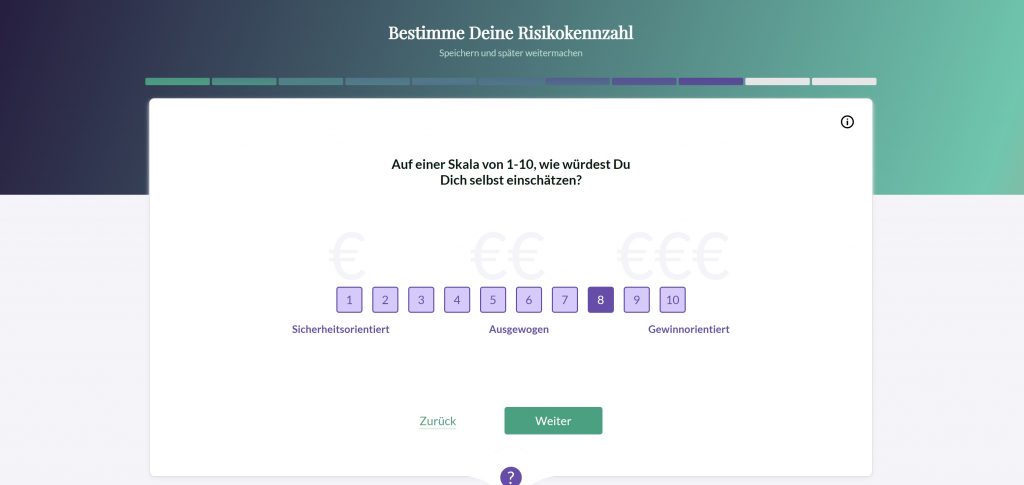

And on a scale of 1 to 10, how would you rate yourself with regards to making portfolio returns?

For example, are you more safe and steady, or chasing more aggressive profits?

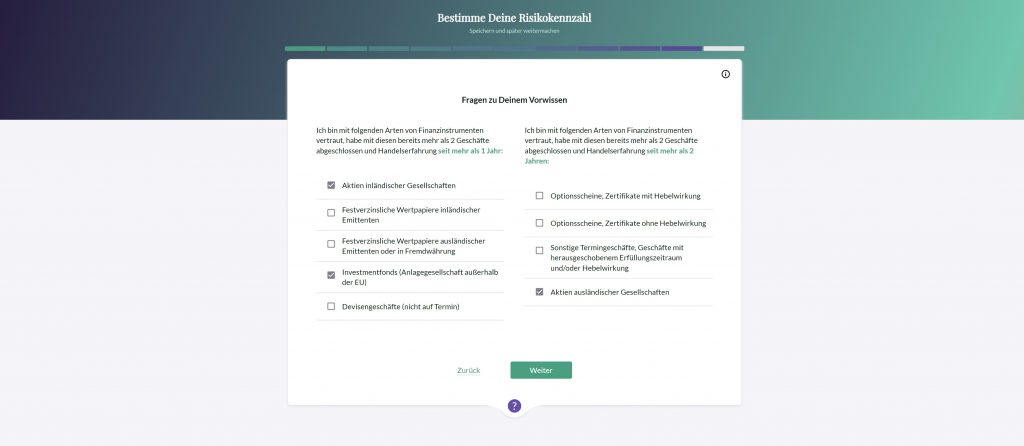

Now you can indicate how knowledgeable you are about investing and money matters in general. Be honest and make your choices:

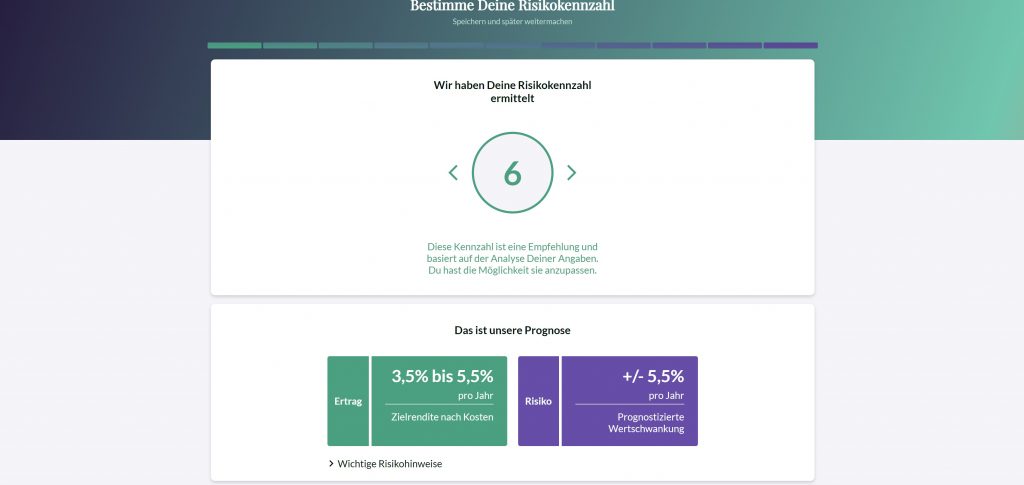

Well done! You’ve completed the first steps and have an indication on your risk profile and potential portfolio, including the estimated yearly returns:

Scroll down to see more details of the proposed portfolio and some explainations:

And thats it!

You’ve completed the onboarding and built your first portfolio.

🎁 Reader Bonus: If you are ready to try Evergreen, don’t forget to use this link when you register to take advantage of their latest promotions.

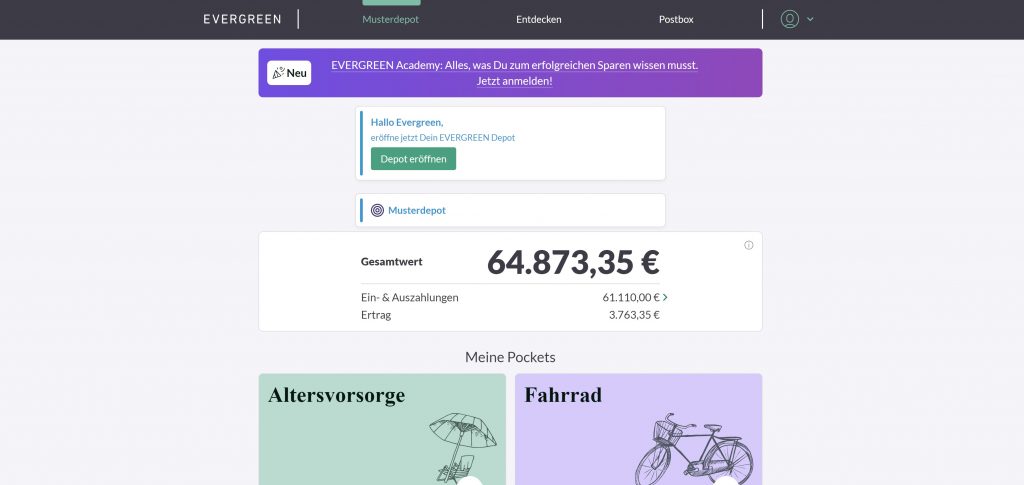

Logging in for the first time

Once you’ve completed the onboarding process above, you’ll have access to your personal dashboard, here is an example of how it will look like:

Once you complete the final verification and onboarding steps, your account will go live and you can start investing.

Funding the account

Funding your account with Evergreen is a pretty seamless process.

The platform allows for straightforward bank transfers, ensuring that your money goes directly into your Evergreen account with no intermediaries involved. The bank details required for the transfer will be provided to you upon opening an account.

While Evergreen currently does not accept funding via credit card, the platform’s quick and easy bank transfer process, coupled with the option to set up a monthly direct debit, makes it a convenient option for funding your account.

It’s easy for investors to manage their funds and begin investing with minimal hassle.

Login & Security

Evergreen is fully compliant with industry regulations as a financial services company within the meaning of Section 1 (1a) KWG. The company takes the security and stability of its clients’ assets seriously.

Evergreen’s partner bank, DAB BNP Paribas, serves as a custodian for its clients’ investments. DAB BNP Paribas is a subsidiary of major French bank, BNP Paribas, which is one of the largest banks in Europe and employs around 170,000 people worldwide.

One of the key features of Evergreen’s platform is the added security measures in place to protect clients’ funds. Neither Evergreen nor DAB BNP Paribas have access to clients’ funds at any time. Even in the event that Evergreen would no longer exist, clients’ deposits would remain independent of the company.

In addition, DAB BNP Paribas, has implemented a special fund structure that separates clients’ investments, ensuring that in the unlikely event of the bank’s bankruptcy, clients’ money would still be protected. Clients’ funds can also be transferred to another bank in the worst-case scenario. These added security measures provide peace of mind for clients, making Evergreen a trusted and secure choice for investment.

Fees & Charges

Evergreen has an all-inclusive fee model charges product costs of 0.59 percent annually, which are taken directly from the investment fund. Beyond that, there are no additional costs for clients.

This makes Evergreen one of the most cost-effective robo-advisors in the market. However, it’s worth noting that the platform does not use ETFs, which means that product costs may be slightly higher than some other providers that rely solely on ETFs. Nevertheless, the platform’s service is still very affordable and a great value for German investors.

The all-inclusive fee model makes it a very affordable and accessible option on the market.

Customer Support

Support with Evergreen is straight forward. It was prompt and efficient when I tested them with a cold email with a few questions I had – so no issues there.

From the website you have the phone (open Monday to Friday until 6PM) and email, however there is no live chat functionality.

Despite that, the external reviews for Evergreen are also very positive as it relates to support response times, so email and phone should be easy enough to solve any problems you encounter.

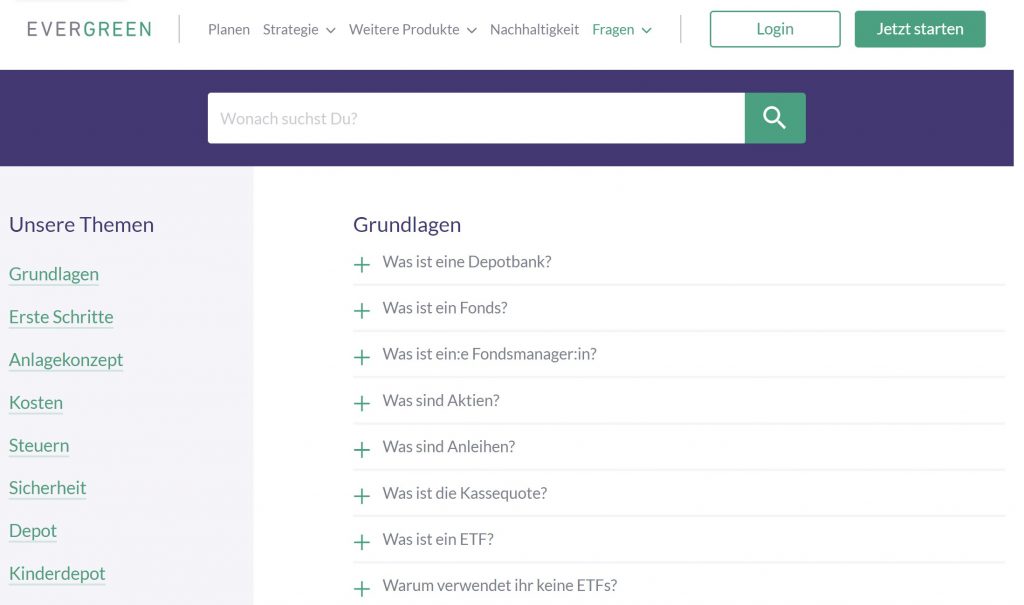

In addition they have a huge FAQ section which really covers every question you can imagine.

Additional Resources

Like Quirion, Evergreen also offer a learning ‘evergreen academy’ – a trend we are seeing with the leading roboadvisors.

Check it out here:

blog.evergreen.de/evergreen-academy/

The difference with Evergreen however, is you have to sign up with your email address to access the content. Its a good marketing and customer lead generation strategy for them, but its also worth your while as the content is excellent.

Evergreen also have a good blog, which is regularly updated and you can they have a strategy and publishing plan behind it – they are not just blasting out blog posts when they remember to do it.

Overall, Evergreen’s appear to be working hard on producing new content and useful resources to educate their audience and which is great to to see.

Background info on Evergreen

In 2018, Iven Kurz founded Evergreen, and officially launched in early 2020. Based in Leipzig, Germany, Evergreen is a regulated provider, overseen by BaFin, the German Federal Financial Supervisory Authority.

They are headquartered in Dittrichring 2, 04109 Leipzig, Germany

Reader offers & deals

If you’re ready to try Evergreen, don’t forget to use this link when you register to take advantage of their latest promotions.

Evergreen has run other promotions and offers in the past, so be sure to check out their homepage for the latest deals and incentives.

Closing thoughts

I love what Evergreen are offering.

They offer a total of 10 broadly diversified portfolios across different risk classes, based on their proprietary public funds “Evergreen PDI Yin” and “Evergreen PDI Yang”. These portfolios are designed to provide investors with optimal diversification and are based on the innovative investment strategy, “Passive Dynamic Investing”.

This strategy involves mapping asset classes using futures, which allows for daily monitoring and adjustments to the respective market situation. This enables investors to preserve their value and make informed investment decisions. The investment strategy invests in up to four asset classes including stocks, bonds, cash, and currencies.

One of the standout features of Evergreen is its minimum investment of just one euro, making it accessible to a wide range of investors. Additionally, the platform’s product costs are just 0.59 percent per year, beyond that there are no additional costs. This makes Evergreen an attractive option for those looking for a cost-effective way to invest.

In summary, Evergreen’s innovative approach to investment, combined with its accessible minimum investment and low cost structure, makes it a solid choice for investors of all levels. The platform’s diversified portfolio options and dynamic value preservation strategy make it a valuable addition to any investors’ portfolio.

Overall, a great choice. Check them out for yourself.

🎁 Reader Bonus: If you are ready to try Evergreen, don’t forget to use this link when you register to take advantage of their latest promotions.

FAQs

Be sure to check out roboadvisors such as Scalable Capital, Whitebox, Growney and Oskar as alternatives to Evergreen.

Yes. Use this link when you register to have the latest offer applied to your account.

Yes. Evergreen are regulated in Germany by the Federal Financial Supervisory Authority (BaFin).

Evergreen is a German investment platform and roboadvisor company that allows investors to easily invest in different investment strategies in an automated way.

Evergreen offers its investors a user-friendly platform with an intuitive onboarding process. It also offers a variety of investment strategies to choose from and allows investors to start with low minimum investment amounts.

Evergreen offers a selection of investment strategies across stock and bond portfolios. Investors can also adjust their risk tolerance to find the most suitable strategy for them.

Evergreen uses industry-standard security measures to protect its clients’ investments. These include encrypting sensitive data and using secure payment methods.

In the event of Evergreen’s insolvency, customers’ investments will be managed by a trustee and returned to investors. However, investors should note that every investment carries risks and there is always a risk of loss.