This page is also available in:

![]() Deutsch

Deutsch

At ZenInvest, I aim to provide the best roboadvisor reviews. To support this, some of the providers featured in reviews will generate an affiliate commission which helps pay to run this website. However, this doesn’t influence my reviews. My opinions are my own. The information provided on Zen Invest is for informational purposes only. Please read the full disclaimer.

Overall rating of my Quirion review

5/5

⭐⭐⭐⭐⭐

‘Industry Leader’

As the world of online investing continues to evolve, an established player has established themselves as the industry leader: Quirion.

This German roboadvisor offers a fresh and modern approach to investment, with a user-friendly platform and streamlined onboarding process. But how does Quirion stack up when it comes to the actual investment options available?

In this review, we’ll take an in-depth look at Quirion, examining everything from the account opening process to the investment options on offer. We’ll also provide our personal insights and opinions on the platform, so you can decide for yourself if Quirion is the right choice for you.

To start, visit the Quirion website and follow along with our guide as we walk you through the account opening process. And be sure to read the FAQs at the end of the review, where we address some of the most common questions about Quirion. Let’s dive in and discover if this roboadvisor is the right fit for your investment needs

🎁 Reader Bonus: If you are ready to try Quirion, don’t forget to use this link when you register to take advantage of their latest promotions.

Quirion Review: Pros and Cons

Quirion is a fantastic choice for those just starting their investing journey. The platform’s sleek and user-friendly onboarding process makes opening an account a breeze, and with the ability to start investing for free under 10K EUR, it makes it accessible to a wide range of investors.

Although the platform may not offer English language support for expats, the simple and intuitive interface, along with the excellent customer service, make it a great option for beginners.

If you’re just starting out and looking for a reliable roboadvisor to guide you on your investment journey, Quirion is definitely worth considering.

| Pros | Cons |

|

|

How to open an account with Quirion

Head over to the homepage at Quirion to get started.

> Click here to open the homepage

Click ‘Depot eröffnen’ to get start:

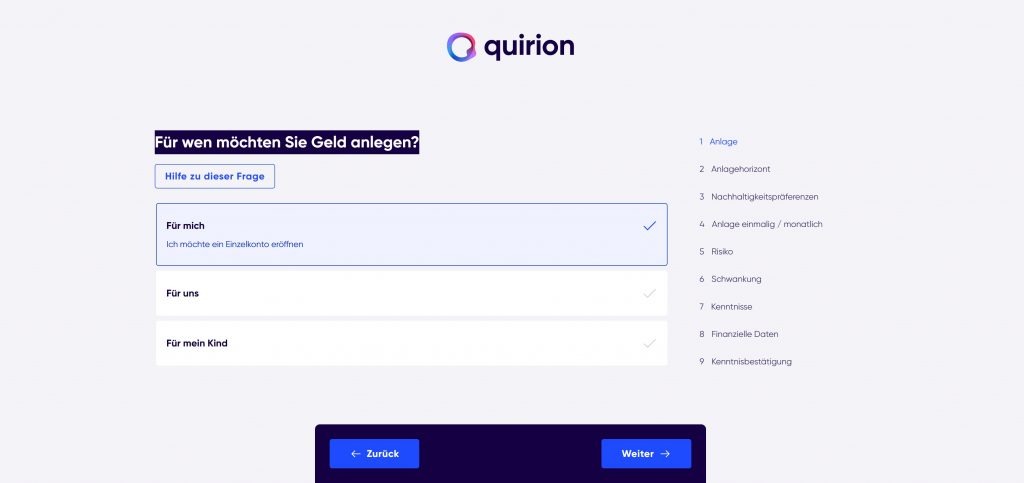

Next, select who you are doing this for and click ‘Weiter’:

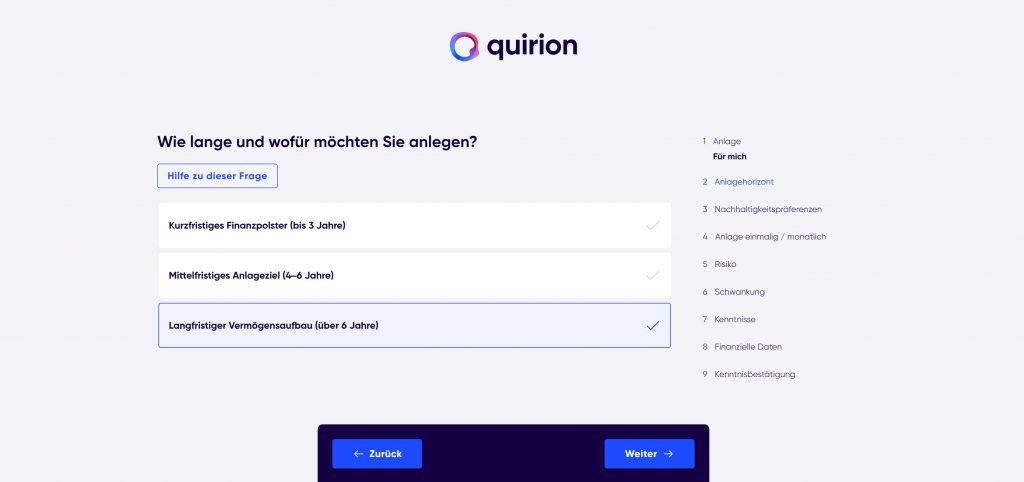

How long are you looking to invest for? Make your choice…

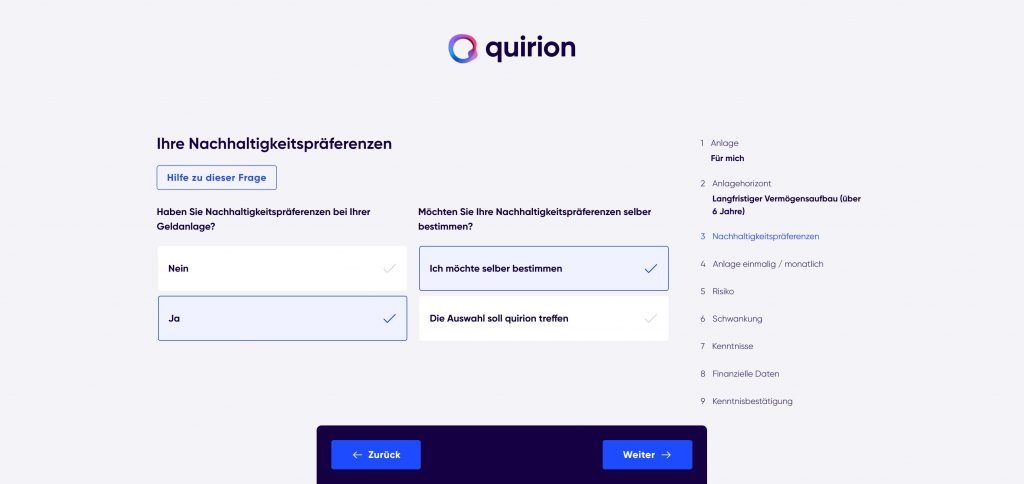

Are you looking for sustainability options with your investing? Make your selection and lets carry on…

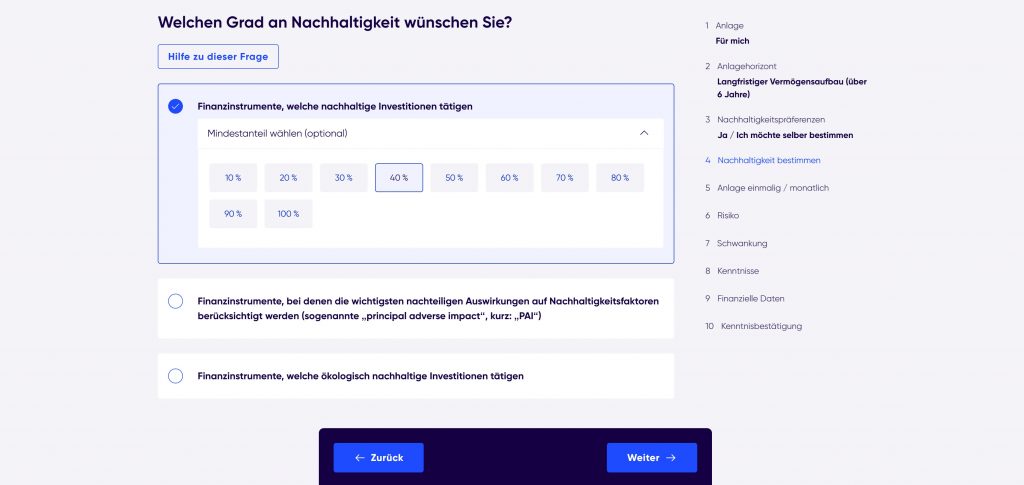

Now you can be more specific, click ‘Hilfe’ if you get stuck…

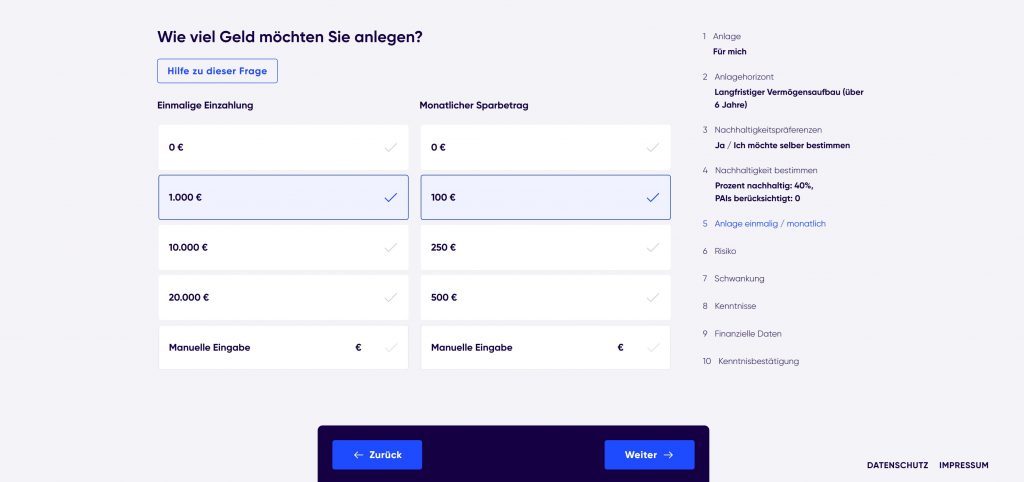

How much are you looking to invest to start with, and then how much per month?

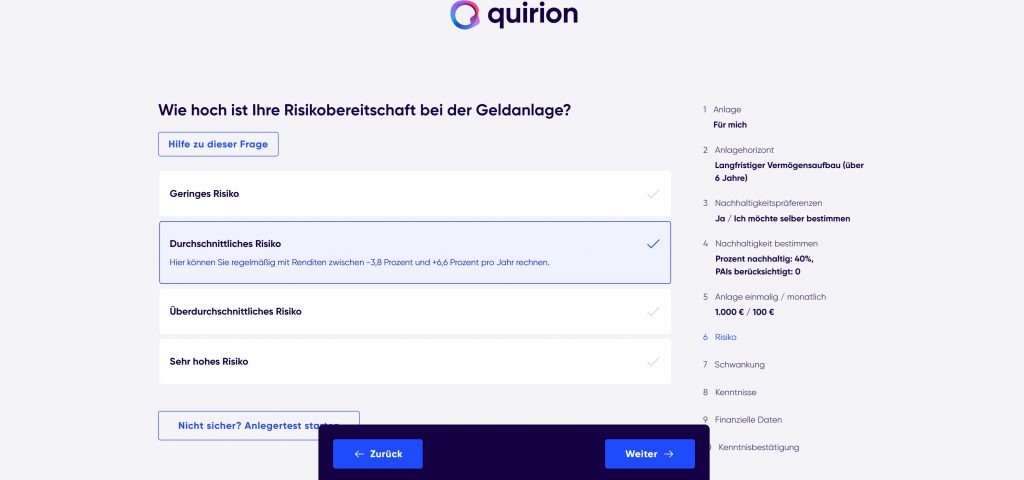

Next, a question about your risk tolerance – how comfortable are you with prices swings and volatility in the stock market? Make your selection and lets move on..

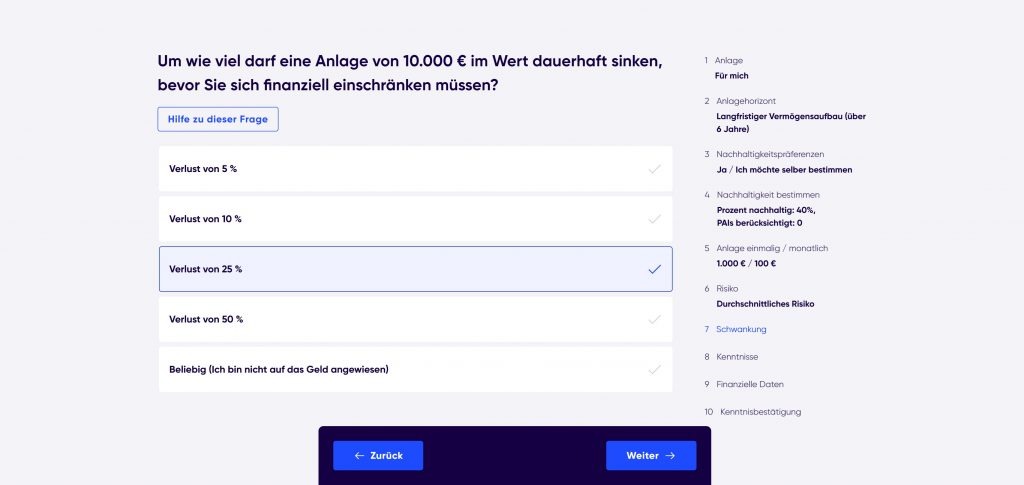

Next answer the question on how much can an investment of €10,000 fall in value before you have personal financial challenges?

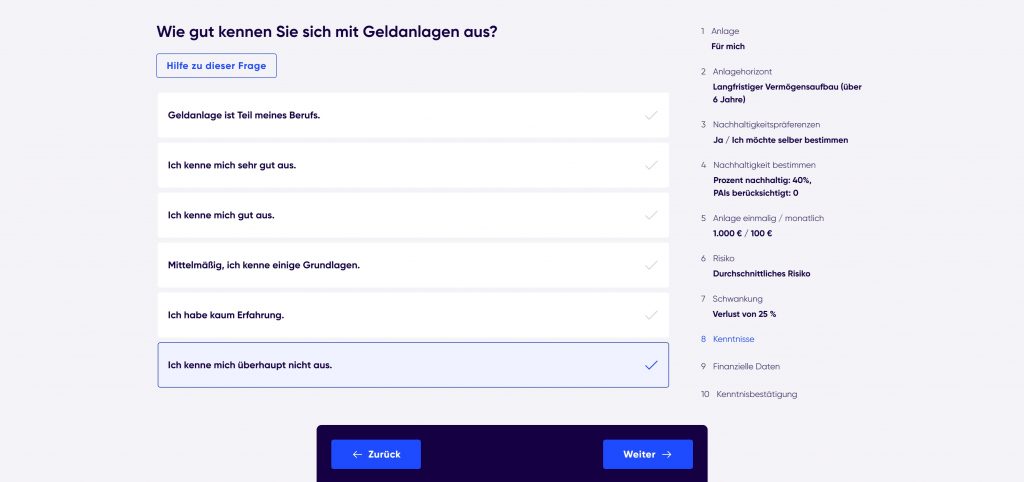

How familiar are you with investing? Maybe a newbee or a pro…Be honest and make your choice…

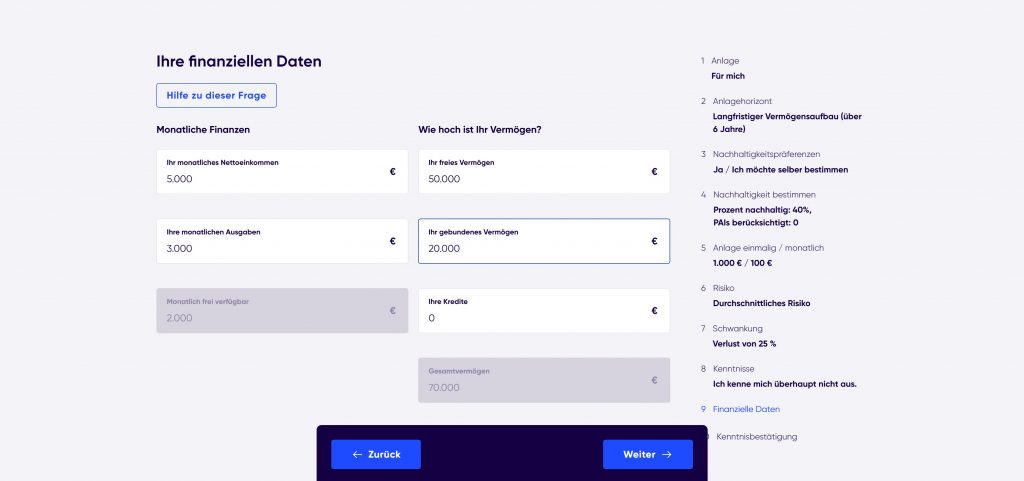

Now enter details about your financial situation – monthly income, savings etc:

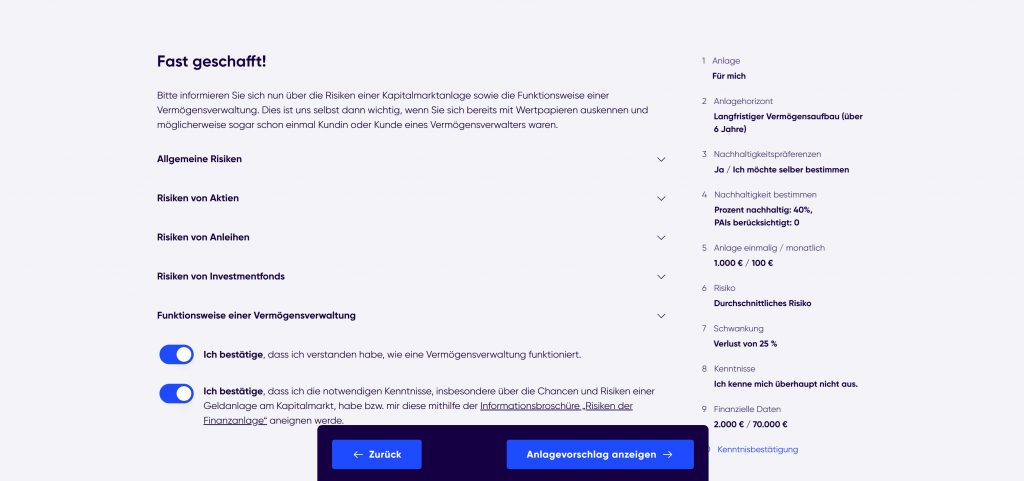

Almost done! Here you can review your inputs and edit if needed. Everything good? Hit next…

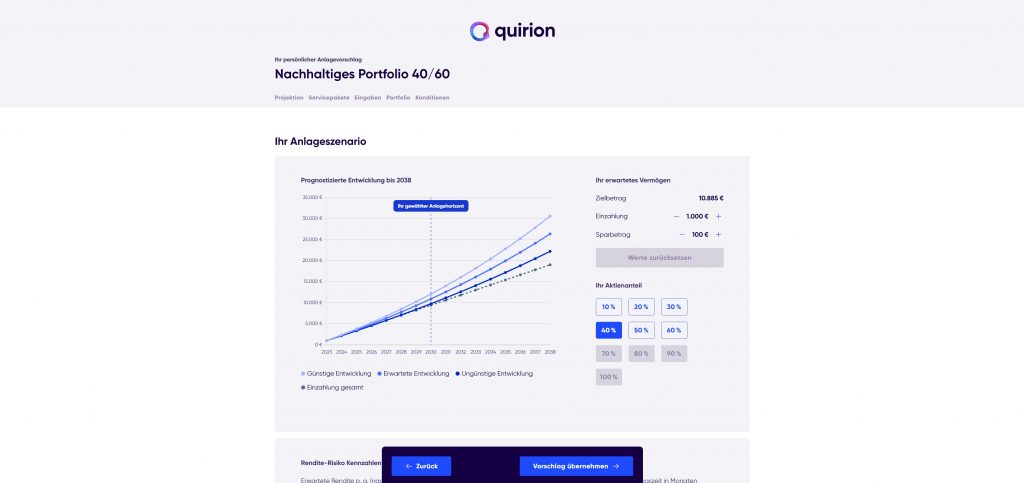

Now you get to see your sample portfolio, and you can use the filters to edit and tweak the portfolio allocation.

Have a go and see for yourself:

Ready to move on?

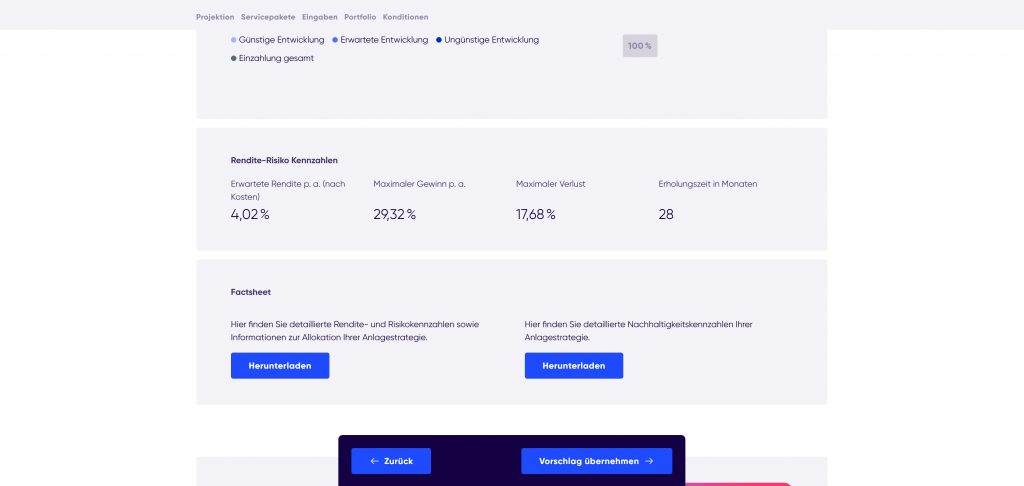

Scroll down to see more details on your proposed portfolio.

Once you happy, hit next to continue.

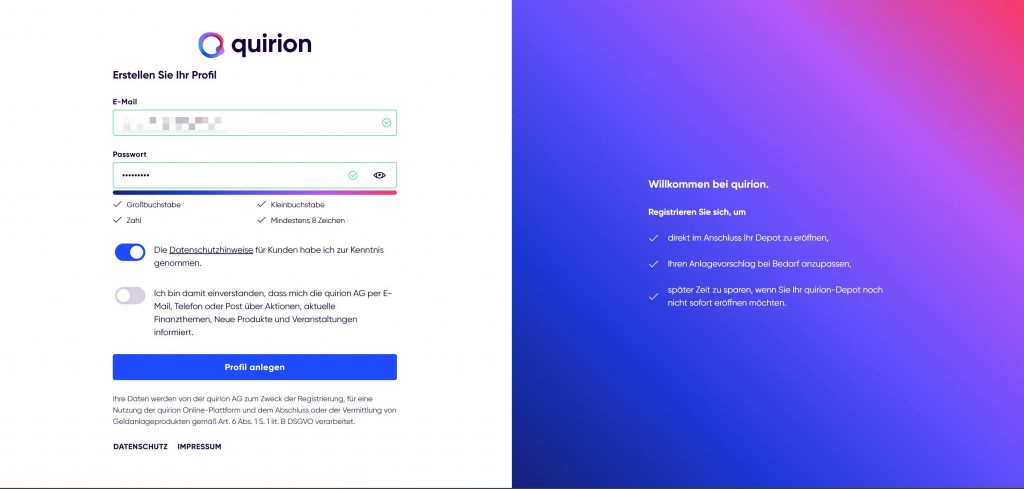

Now we move onto the final stages, enter your email and create a unique password to setup your account:

You’ll then need to switch to your email inbox to confirm your address:

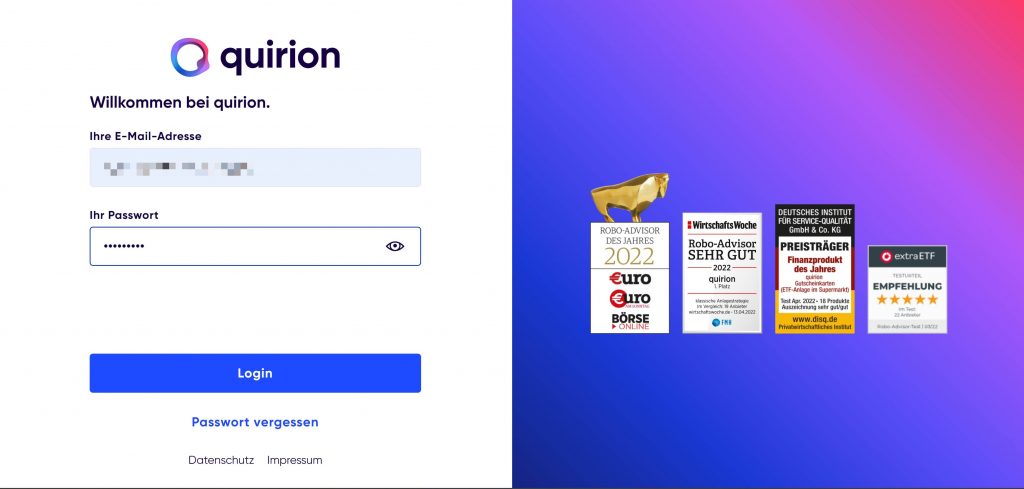

So click the confirmation link, and then login with the details you set earlier:

Ok congrats, all done!

🎁 Reader Bonus: If you are ready to try Quirion, don’t forget to use this link when you register to have your bonus applied

Logging in for the first time

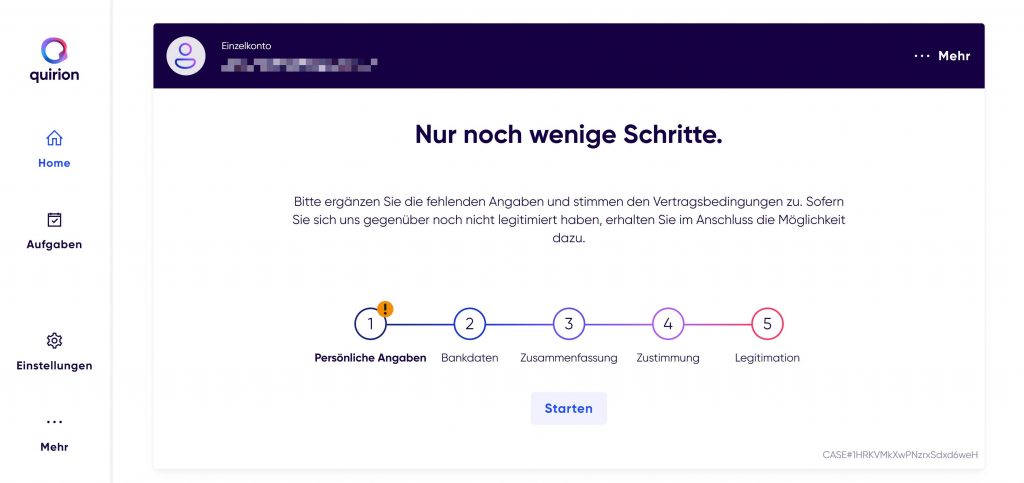

Once you’ve completed the above steps and logged in, you’ll be presented with a dashboard to complete the account funding, verification and final onboarding steps for your quirion account:

Once completed and verified, you’ll be able to start investing.

Funding the account

Funding your account is straight forward via bank transfer, which go into your Quirion account directly and no third parties are in-between. The bank details are given to you when you open the account.

While you can’t fund the account via credit card, the process is quick and easy via bank transfer, and a monthly direct debit can also be setup.

Login & Security

As a customer of Quirion, your investment is safeguarded by the reputable and licensed Quirin Privatbank AG. This German private bank, based in Berlin, boasts a team of 250 experts and manages over 4 billion euros in customer deposits.

Not only is Quirin Privatbank AG regulated by BaFin, the Federal Association of German Banks, but it also belongs to the Deposit Protection Fund, ensuring that even in the unlikely event of the bank’s insolvency, your funds are protected up to 100,000 euros. Furthermore, the BdB offers an additional layer of security, with a limit of several million euros for Quirin Privatbank AG.

Rest assured that your securities are kept as special assets and are separated from the bank’s own assets. In the event of the bank’s insolvency, your portfolio can be transferred to another financial institution. All transactions, including deposits and withdrawals, are processed through a reference account of your choice, typically a checking account, and assets can never be transferred to third-party accounts.

Quirion also prioritizes security, using secure TLS/SSL encryption for all files, and all servers are located in a German data center, adhering to the strictest German data protection standards. Trust in the safety and security of your investments with Quirion.

Fees & Charges

When it comes to investing with Quirion, there are two key costs to keep in mind: the management fee and ongoing fund costs.

The management fee, which ranges from 0.48 to 1.20 percent annually, covers everything from asset management and transaction costs to account and custody account management. These fees are offset monthly against the balance on the clearing account.

One of the standout features of Quirion is its digital package, which allows for the first 10,000 euros to be invested free of charge for a year. This is a great benefit for German investors looking to try out the platform.

In terms of ongoing fund costs, Quirion maintains an average of around 0.23 percent per year, which is taken directly from the fund assets once they have been determined. It’s worth noting that these costs are in line with industry standards and are very competitive for an established roboadvisor.

Customer Support

In my tests, customer support was good with quick responses and answers to my test questions about account opening.

Quirion make support very easy to access – with a dedicated hub page to select your preferred option. They support email, phone and live chat.

The local phone support is based in Germany and not offshore, and operates until 6PM.

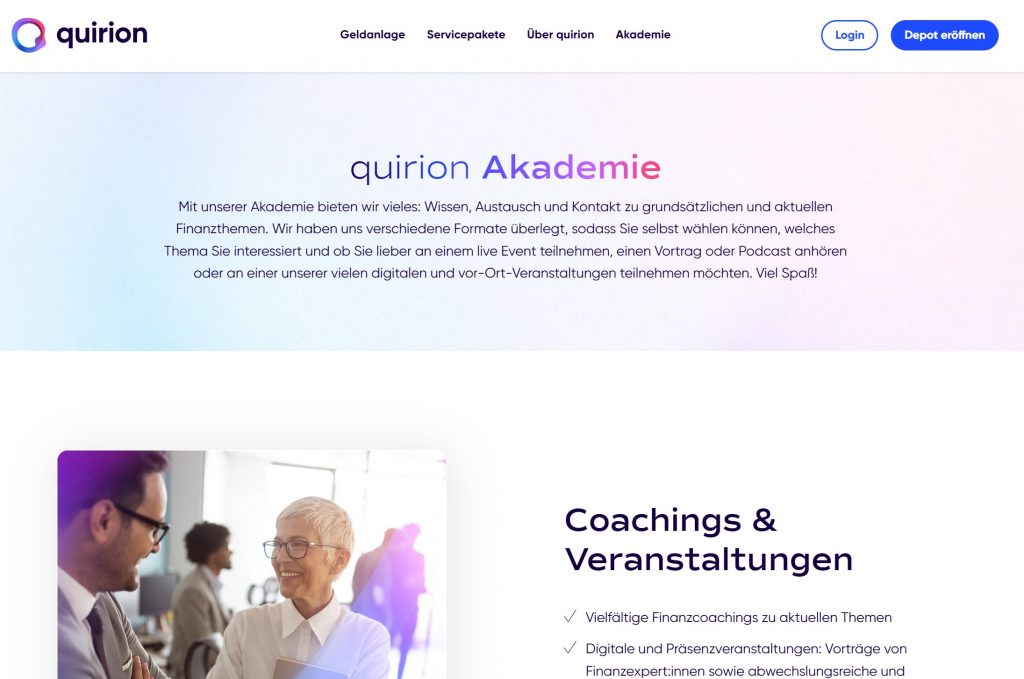

In addition to that, they have a comprehensive FAQ section and ‘quirion academy’ (see below) to cover further common topics in more detail.

Additional Resources

Quirion offer a wealth of educational resources to help investors of all experience levels via their ‘quirion academy’ which is full of content.

From their in-depth blog articles, newsletters and magazine, to whitepapers, webinars and additional materials, there is no shortage of information available to those who want to learn more about investing.

While the content is primarily in German, it is still accessible and well-designed, making it easy for users to navigate and find the information they need. Additionally, Quirion is also active on various social media channels, and has a strong presence on platforms like LinkedIn, Facebook, and Twitter.

It’s great to see Quirion investing in educational resources for their users, and although the language barrier may be challenging for expats, it is an opportunity to learn and expand one’s knowledge of the German language!

Overall, Quirion’s commitment to educating and informing investors is a major advantage of the platform.

Background info on Quirion

Quirion was founded in 2013 by by Karl Matthäus Schmidt, originally under the brand name Quirin Privatbank AG.

Karl is considered a ‘pioneer’ having founded the online broker ‘Consors’ at the age of 25 and then in 2006 the Quirin Privatbank, Germany’s first fee-based consulting bank.

Today, they employ over 250 people and look after customers assets with an investment volume of over EUR 4 billion.

They are headquartered in Kurfürstendamm 119, 10711 Berlin.

Reader offers & deals

If you are ready to try Quirion, don’t forget to use this link when you register to take advantage of their latest promotions.

Quirion have run other promotions and offers in the past, so check out their homepage for the latest.

Closing thoughts

I’m a fan of the Quirion platform.

Quirion offers a unique approach to investing through their broad diversification strategies across multiple asset classes, including stocks and bonds.

This approach allows for balancing out fluctuations in the market, providing peace of mind for investors. The platform offers a variety of investment strategies to choose from, each with varying equity quotas, allowing customers to find the perfect fit for their specific needs.

One of the standout features of Quirion is their low administration costs, with their digital package even offering free management for investments under 10,000 euros.

This cost-effective approach is a major selling point for budget-conscious investors looking to maximize their returns. Overall, Quirion’s diversified strategies and cost-efficient approach make it a solid choice for those looking to invest their money wisely.

In short, they are industry leaders. Check them out for yourself.

🎁 Reader Bonus: If you are ready to try Quirion, don’t forget to use this link when you register to take advantage of their latest promotions.

FAQs

Be sure to check out roboadvisors such as Scalable Capital, Whitebox, Growney and Oskar as alternatives to Quirion.

Yes. Use this link when you register to have 10K EUR managed free for 12 months.

Yes. Quirion are regulated in Germany by the Federal Financial Supervisory Authority (BaFin).

Quirion is a German investment platform and roboadvisor company that allows investors to easily invest in different investment strategies in an automated way.

Quirion offers its investors a user-friendly platform with an intuitive onboarding process. It also offers a variety of investment strategies to choose from and allows investors to start with low minimum investment amounts.

Quirion offers a selection of investment strategies such as ETF portfolios, stock portfolios, and bond portfolios. Investors can also adjust their risk tolerance to find the most suitable strategy for them.

Quirion uses industry-standard security measures to protect its clients’ investments. These include encrypting sensitive data and using secure payment methods.

In the event of Quirion’s insolvency, customers’ investments will be managed by a trustee and returned to investors. However, investors should note that every investment carries risks and there is always a risk of loss.